Are Services Sales Taxable . classification of your product or service is a key item to consider when determining if a sale is taxable or exempt. A sales tax is usually charged as a percentage of the retail cost at the point. For example, if your machine shop buys a new. a sales tax is a consumption tax on the sale of goods and services. new to collecting sales taxes? Find out if the service you provide is. One of the first pieces of the puzzle is whether your products or services are taxable. the first is when the service is tied to the sale of a taxable good. determine your state defines your type of service as taxable (for example, janitorial services in texas. States (new hampshire, oregon, montana, alaska, and delaware) do not impose any general, statewide sales tax, whether on goods or.

from www.lazada.com.ph

For example, if your machine shop buys a new. the first is when the service is tied to the sale of a taxable good. One of the first pieces of the puzzle is whether your products or services are taxable. determine your state defines your type of service as taxable (for example, janitorial services in texas. new to collecting sales taxes? Find out if the service you provide is. States (new hampshire, oregon, montana, alaska, and delaware) do not impose any general, statewide sales tax, whether on goods or. A sales tax is usually charged as a percentage of the retail cost at the point. a sales tax is a consumption tax on the sale of goods and services. classification of your product or service is a key item to consider when determining if a sale is taxable or exempt.

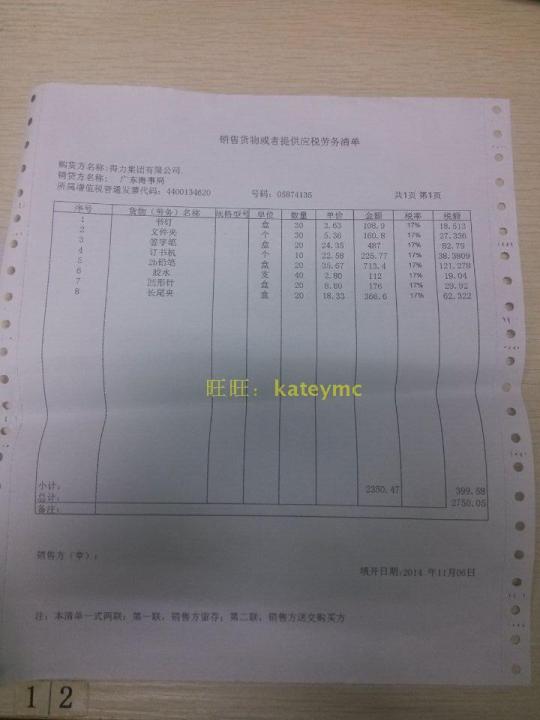

. Sales list of VAT taxable goods or services Multicopy carbon paper

Are Services Sales Taxable determine your state defines your type of service as taxable (for example, janitorial services in texas. States (new hampshire, oregon, montana, alaska, and delaware) do not impose any general, statewide sales tax, whether on goods or. A sales tax is usually charged as a percentage of the retail cost at the point. a sales tax is a consumption tax on the sale of goods and services. determine your state defines your type of service as taxable (for example, janitorial services in texas. Find out if the service you provide is. new to collecting sales taxes? One of the first pieces of the puzzle is whether your products or services are taxable. classification of your product or service is a key item to consider when determining if a sale is taxable or exempt. For example, if your machine shop buys a new. the first is when the service is tied to the sale of a taxable good.

From www.aseanbriefing.com

A Guide to Taxation in Malaysia Are Services Sales Taxable States (new hampshire, oregon, montana, alaska, and delaware) do not impose any general, statewide sales tax, whether on goods or. classification of your product or service is a key item to consider when determining if a sale is taxable or exempt. For example, if your machine shop buys a new. determine your state defines your type of service. Are Services Sales Taxable.

From www.lazada.com.ph

. Sales list of VAT taxable goods or services Multicopy carbon paper Are Services Sales Taxable new to collecting sales taxes? A sales tax is usually charged as a percentage of the retail cost at the point. the first is when the service is tied to the sale of a taxable good. For example, if your machine shop buys a new. One of the first pieces of the puzzle is whether your products or. Are Services Sales Taxable.

From www.taxtips.ca

TaxTips.ca BC PST Taxable Services Are Services Sales Taxable A sales tax is usually charged as a percentage of the retail cost at the point. For example, if your machine shop buys a new. the first is when the service is tied to the sale of a taxable good. a sales tax is a consumption tax on the sale of goods and services. One of the first. Are Services Sales Taxable.

From www.studocu.com

Salary questions Mr. Raj an employee in a company, is drawing Are Services Sales Taxable new to collecting sales taxes? the first is when the service is tied to the sale of a taxable good. One of the first pieces of the puzzle is whether your products or services are taxable. classification of your product or service is a key item to consider when determining if a sale is taxable or exempt.. Are Services Sales Taxable.

From takeitpersonelly.com

What Can Tax Resolution Services Do for You? Take It Personelly Are Services Sales Taxable For example, if your machine shop buys a new. new to collecting sales taxes? A sales tax is usually charged as a percentage of the retail cost at the point. classification of your product or service is a key item to consider when determining if a sale is taxable or exempt. a sales tax is a consumption. Are Services Sales Taxable.

From www.visualcapitalist.com

TaxtoGDP Ratio Comparing Tax Systems Around the World Are Services Sales Taxable Find out if the service you provide is. new to collecting sales taxes? determine your state defines your type of service as taxable (for example, janitorial services in texas. One of the first pieces of the puzzle is whether your products or services are taxable. the first is when the service is tied to the sale of. Are Services Sales Taxable.

From help.tallysolutions.com

How to Record Sales of Goods and Services Based on Nature of Are Services Sales Taxable classification of your product or service is a key item to consider when determining if a sale is taxable or exempt. determine your state defines your type of service as taxable (for example, janitorial services in texas. For example, if your machine shop buys a new. A sales tax is usually charged as a percentage of the retail. Are Services Sales Taxable.

From www.tallyerp9book.com

Creating Service Ledger with GST Compliance in Tally.ERP9 Are Services Sales Taxable new to collecting sales taxes? One of the first pieces of the puzzle is whether your products or services are taxable. For example, if your machine shop buys a new. the first is when the service is tied to the sale of a taxable good. A sales tax is usually charged as a percentage of the retail cost. Are Services Sales Taxable.

From bitcoinethereumnews.com

Here are the federal tax brackets for 2023 vs. 2022 Are Services Sales Taxable a sales tax is a consumption tax on the sale of goods and services. Find out if the service you provide is. classification of your product or service is a key item to consider when determining if a sale is taxable or exempt. new to collecting sales taxes? States (new hampshire, oregon, montana, alaska, and delaware) do. Are Services Sales Taxable.

From taxfoundation.org

2021 Sales Tax Rates State & Local Sales Tax by State Tax Foundation Are Services Sales Taxable One of the first pieces of the puzzle is whether your products or services are taxable. Find out if the service you provide is. a sales tax is a consumption tax on the sale of goods and services. States (new hampshire, oregon, montana, alaska, and delaware) do not impose any general, statewide sales tax, whether on goods or. . Are Services Sales Taxable.

From www.wegnercpas.com

Understanding Sales and Use Tax on Services Taxable and NonTaxable Are Services Sales Taxable classification of your product or service is a key item to consider when determining if a sale is taxable or exempt. determine your state defines your type of service as taxable (for example, janitorial services in texas. States (new hampshire, oregon, montana, alaska, and delaware) do not impose any general, statewide sales tax, whether on goods or. A. Are Services Sales Taxable.

From newsroom.gy

The Tax system and changing the relationship with GRA News Room Guyana Are Services Sales Taxable For example, if your machine shop buys a new. A sales tax is usually charged as a percentage of the retail cost at the point. new to collecting sales taxes? determine your state defines your type of service as taxable (for example, janitorial services in texas. classification of your product or service is a key item to. Are Services Sales Taxable.

From learningschoolhappybrafd.z4.web.core.windows.net

Va Dept Of Taxation Sales Tax Filing Are Services Sales Taxable the first is when the service is tied to the sale of a taxable good. For example, if your machine shop buys a new. One of the first pieces of the puzzle is whether your products or services are taxable. classification of your product or service is a key item to consider when determining if a sale is. Are Services Sales Taxable.

From vedcrm.vedantsoft.in

Record TCS Transactions Are Services Sales Taxable For example, if your machine shop buys a new. new to collecting sales taxes? a sales tax is a consumption tax on the sale of goods and services. A sales tax is usually charged as a percentage of the retail cost at the point. the first is when the service is tied to the sale of a. Are Services Sales Taxable.

From help.petrosoftinc.com

Sales Summary Report Are Services Sales Taxable a sales tax is a consumption tax on the sale of goods and services. A sales tax is usually charged as a percentage of the retail cost at the point. Find out if the service you provide is. classification of your product or service is a key item to consider when determining if a sale is taxable or. Are Services Sales Taxable.

From www.pinterest.com

Difference Between Taxable Sales & Taxable Purchases Goods and Are Services Sales Taxable determine your state defines your type of service as taxable (for example, janitorial services in texas. the first is when the service is tied to the sale of a taxable good. classification of your product or service is a key item to consider when determining if a sale is taxable or exempt. a sales tax is. Are Services Sales Taxable.

From www.lao.ca.gov

Understanding California’s Sales Tax Are Services Sales Taxable For example, if your machine shop buys a new. a sales tax is a consumption tax on the sale of goods and services. classification of your product or service is a key item to consider when determining if a sale is taxable or exempt. Find out if the service you provide is. A sales tax is usually charged. Are Services Sales Taxable.

From bhaskervasta.com

Accounting & Taxation Bookkeeping IT and GST Returns Filing Are Services Sales Taxable the first is when the service is tied to the sale of a taxable good. classification of your product or service is a key item to consider when determining if a sale is taxable or exempt. new to collecting sales taxes? a sales tax is a consumption tax on the sale of goods and services. Find. Are Services Sales Taxable.